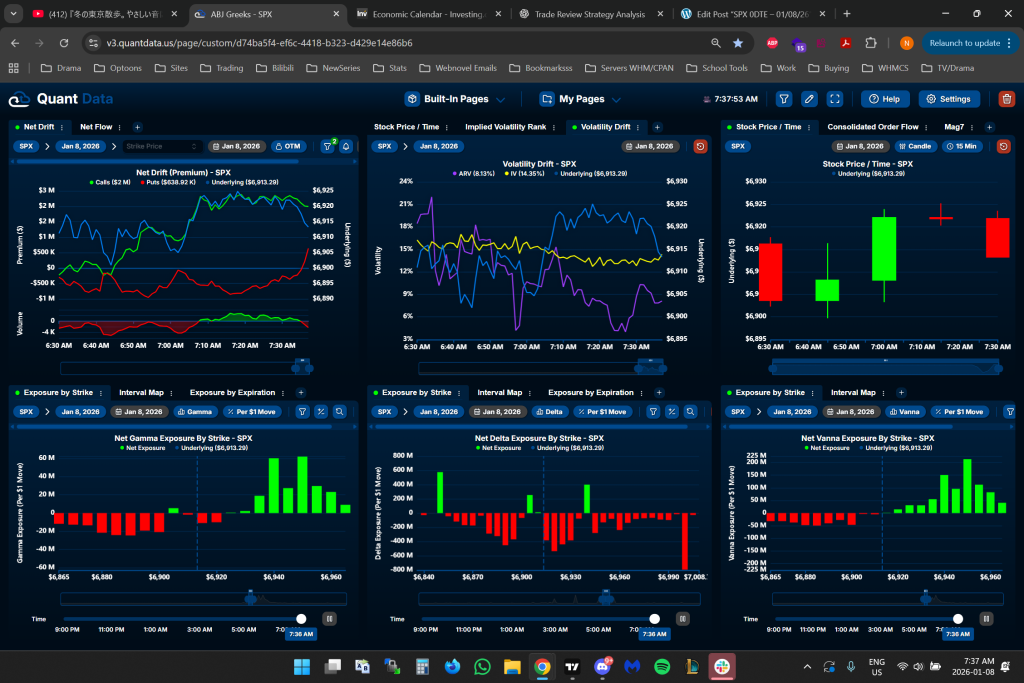

Today was one of those days where I probably should have waited, I Would have definitely been able to get more premium if i just waited but sometimes fomo beats the best of us. Deltas were signaling for downside however markets pumped up to the previous day close range. I sold calls because i felt deltas were more probable of happening but i got stopped out at $0.80 but then price started to hover so I got in at $0.70. If I was to do my calculations correctly instead of selling $0.50 per contract I basically sold each one for $0.40. As of now its 7:49 and its currently sitting at a 10% loss now. But I think if it goes lower I can take profit at $0.10. I definitely know that from now on i should look at the ATR lvls and get in trades when one is close to breaching or has breached and use it for confirmations on the VWAP as well as the 9/20 emas. Will post an update in 30 minutes if the markets do anything or an hour later from now if I’m still in the trade. My stop loss is a close above the purple line which is the previous day close.

Update: So it’s 9:12 AM, the market has just been ranging. I almost got stopped out at 9 AM but luckily it went back down a little. As of now the premium is at $0.40 which is breakeven. I’m either going to take a bit of profit soon in the next 30-60 minutes or just take the day with a small loss if it reaches my cut loss area.

Update: So it’s 9:20 AM, I decided to close my positions at $0.50 since the deltas all changed to green in the area that was red so i didn’t want to risk. I could be worrying for nothing but, all in all the heavy losses that i originally incurred(-120) became a small loss. Its a $35 loss which is pretty small. We will make it back tomorrow ^.^