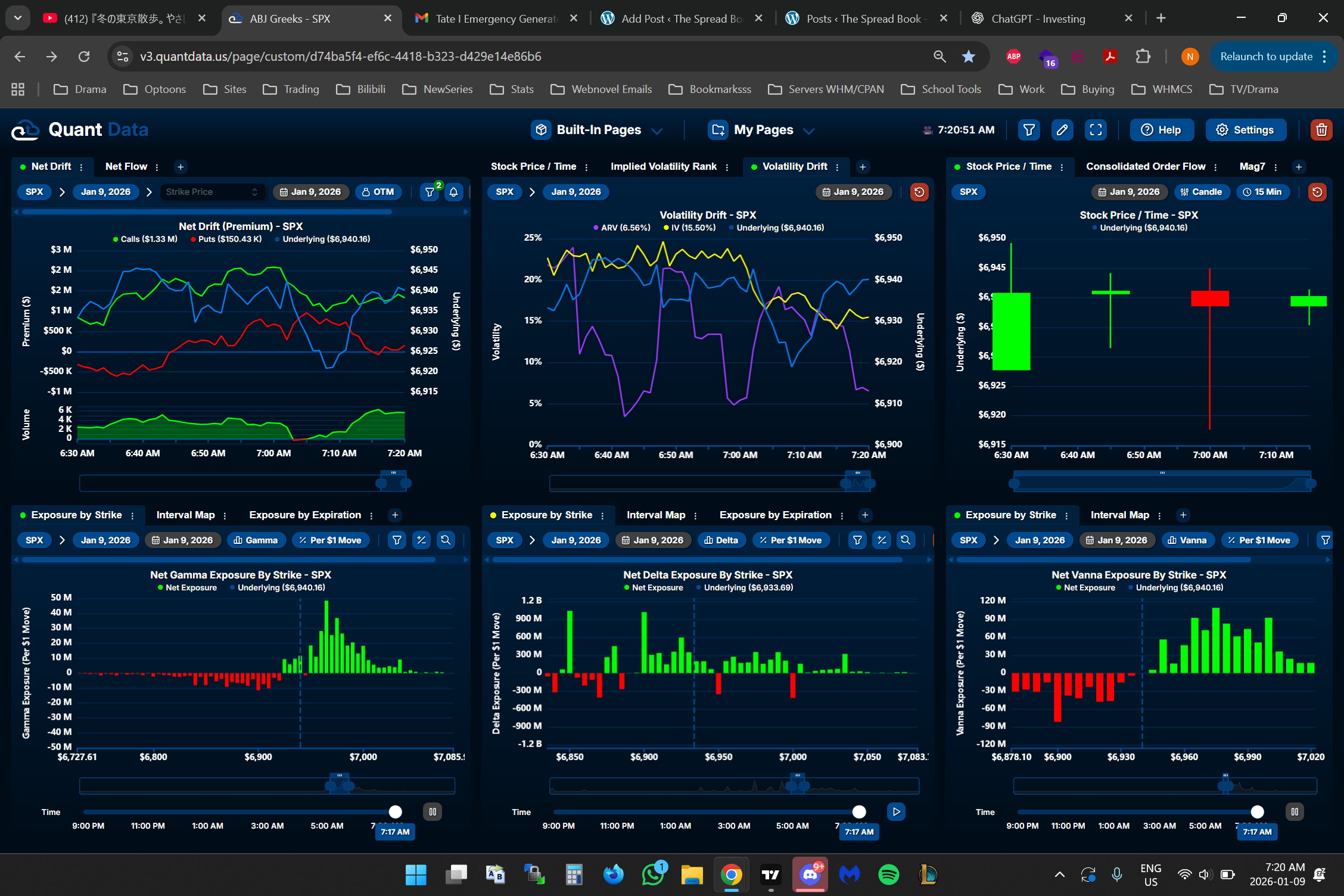

So today I sold 2 contracts at 6890/6885 puts for $0.50 when IV was high and near VWAP. It was a bit high due to 7 AM PST News. I chose these strikes because it was way below the previous day close. When news dropped, the price dipped but because there was no more further news, IV also dropped meaning we weren’t down as much. I set my stop loss at the red horizontal line which was a little further down past the previous day close which was 6920. I doubled down and sold another contract when price started to for $0.70. It is 7:26 AM PST and price is currently jumped up to 6955 which is a 30 point bounce. I took profit at $0.20. Secured a decent amount of profit.